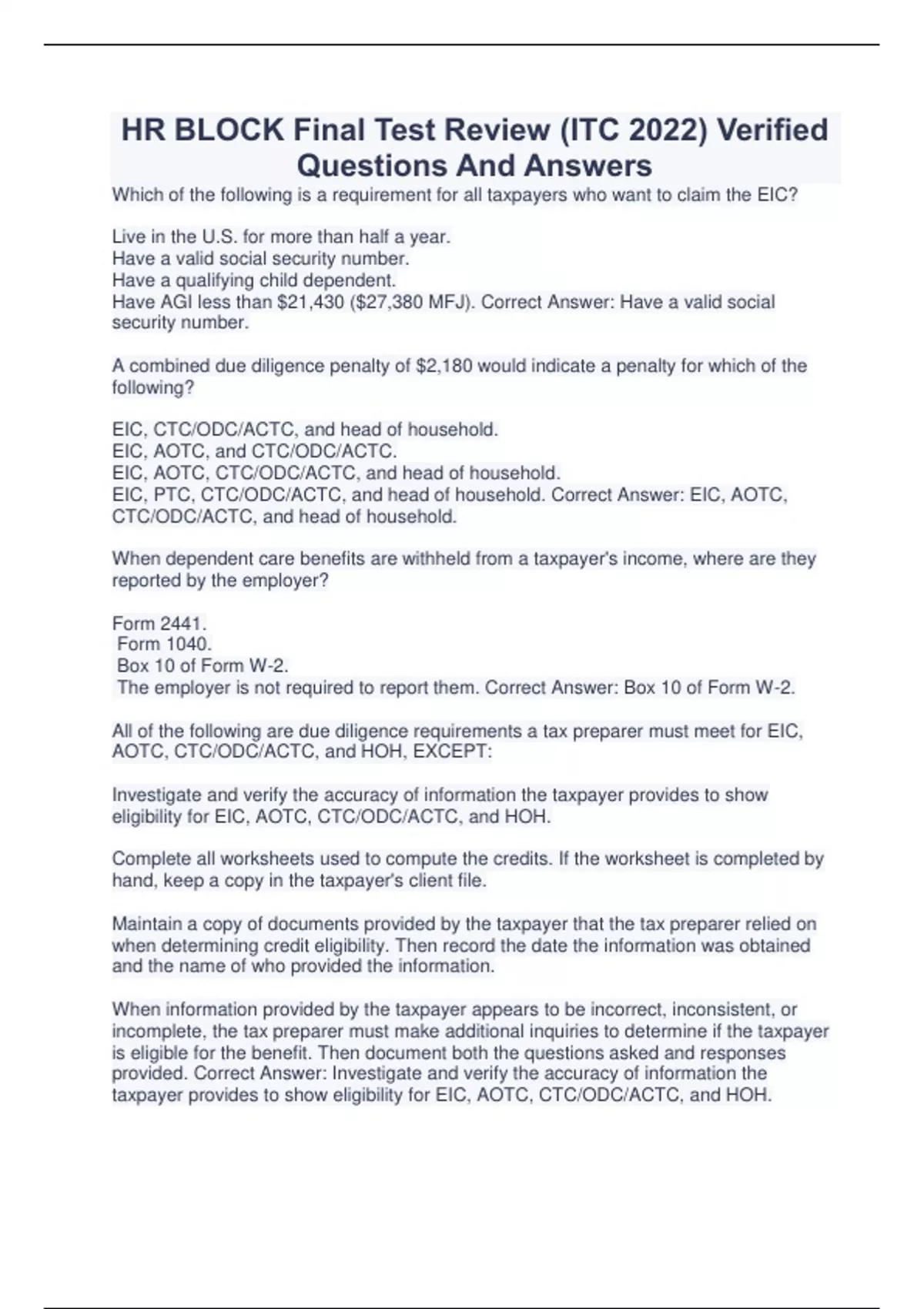

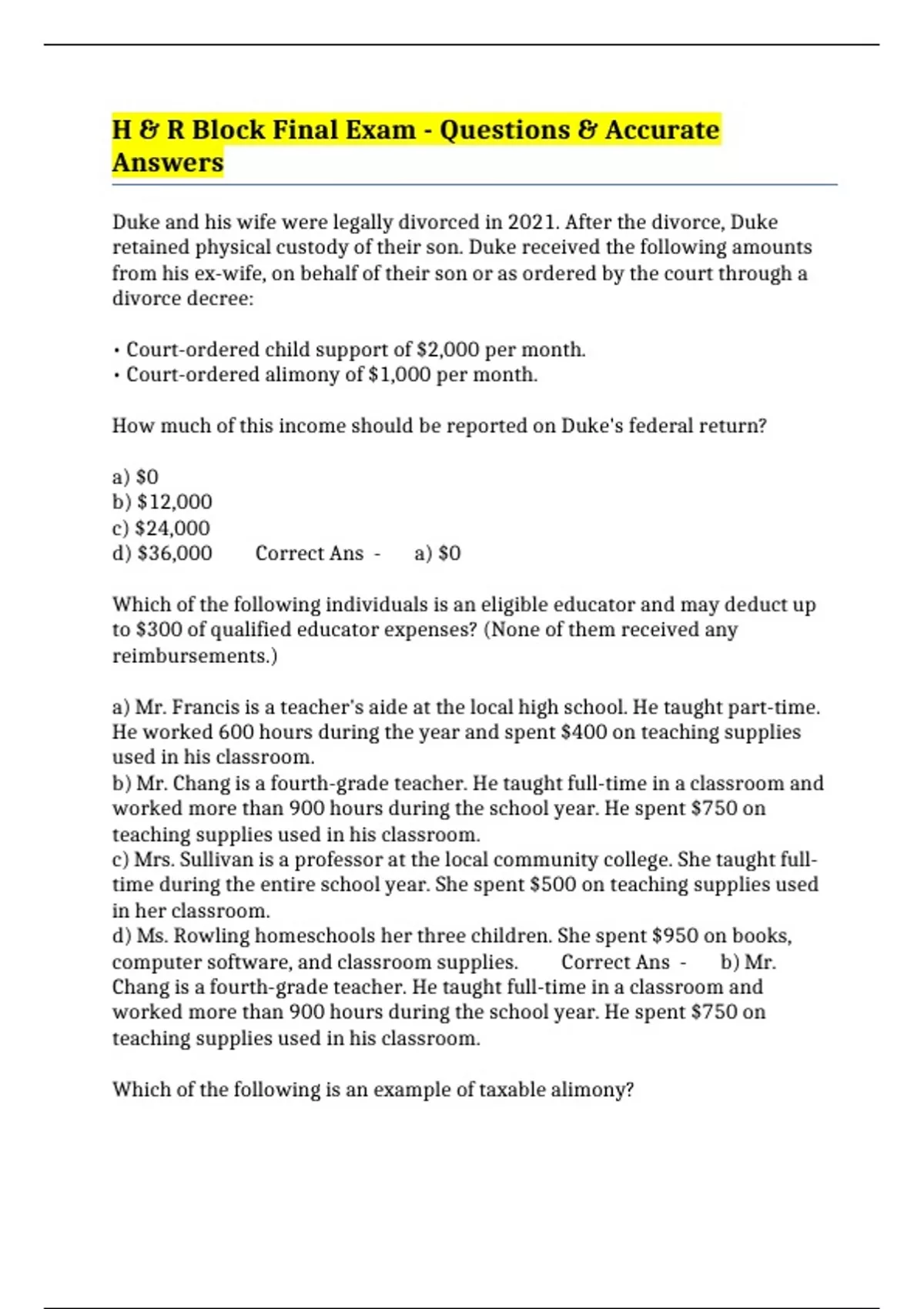

Webhe borrowed $900,000 and purchased a new main home in march of 2020. Soledad will be itemizing his deductions. On what portion of the acquisition debt will interest be deductible on soledad's tax return for 2022? Complete questions & answers (grad... Webwith these case studies, you will be able to identify the where, how, what, and how of the h&r block final exam case study answer. Some of the main characteristics of descriptive case studies include: Web3 days ago · study with quizlet and memorize flashcards containing terms like which of the following is a requirement for all taxpayers who want to claim the eic? Live in the u. s. For more than half a year. Have a valid social security number.

Related Posts

Recent Post

- Indeed Jobs Elizabeth City Nc

- Does Dana Perino Have Children

- Sissylife

- Wreck I20 East

- Alicia Menendez Pictures

- Home Depot Twitter

- Fetch Your News Pickens County

- Youtube Basebakk Player Pranked By Hall Of Famer

- My Journal Courier Obituaries

- Jd Advising July 2024 Predictions

- Zoom Umd Edu

- Academic Guide Uc Berkeley

- Car Crash In Seattle Washington

- Is Nbme 14 Hard

- Zillow Rentals Oakland Ca

Trending Keywords

Recent Search

- Butt Creepshots

- Planters Bee Swarm

- Daily Horoscope By Jessica Adams

- Finish Carpentry Jobs Near Me

- The Proud Family Wikipedia

- Homes For Sale Orlando Fl Zillow

- Los Angeles Police Helicopter Activity

- Lawton Constitution Newspaper Archives

- Prison Pen Pals Women

- Real Hotwife Text

- Kern Inmate Search

- Drake Twitter Trending Twitter

- Sexy Facial Gifs

- Johns Hopkins Employee Self Service

- Providence Journal Rhode Island Obituaries