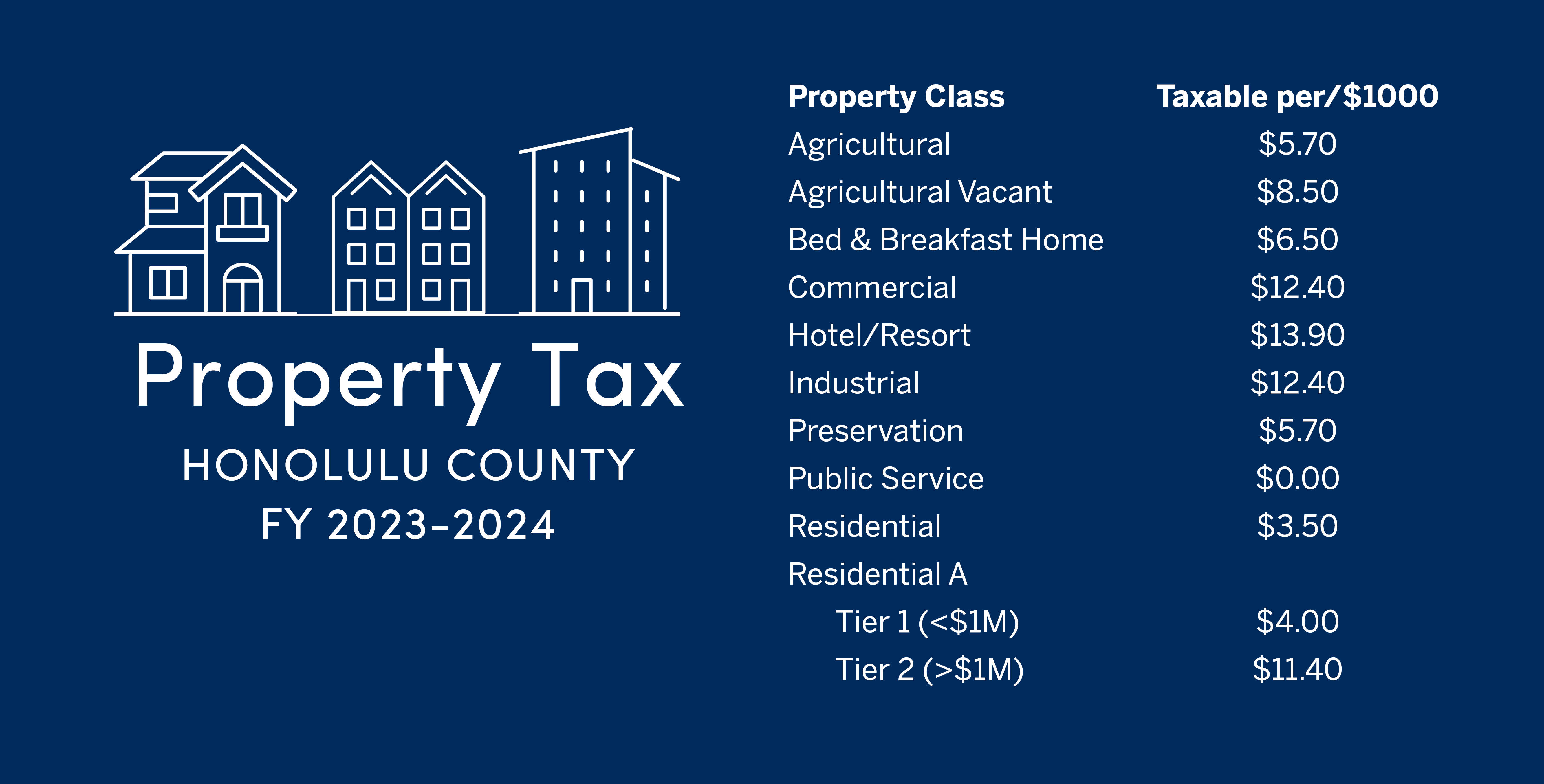

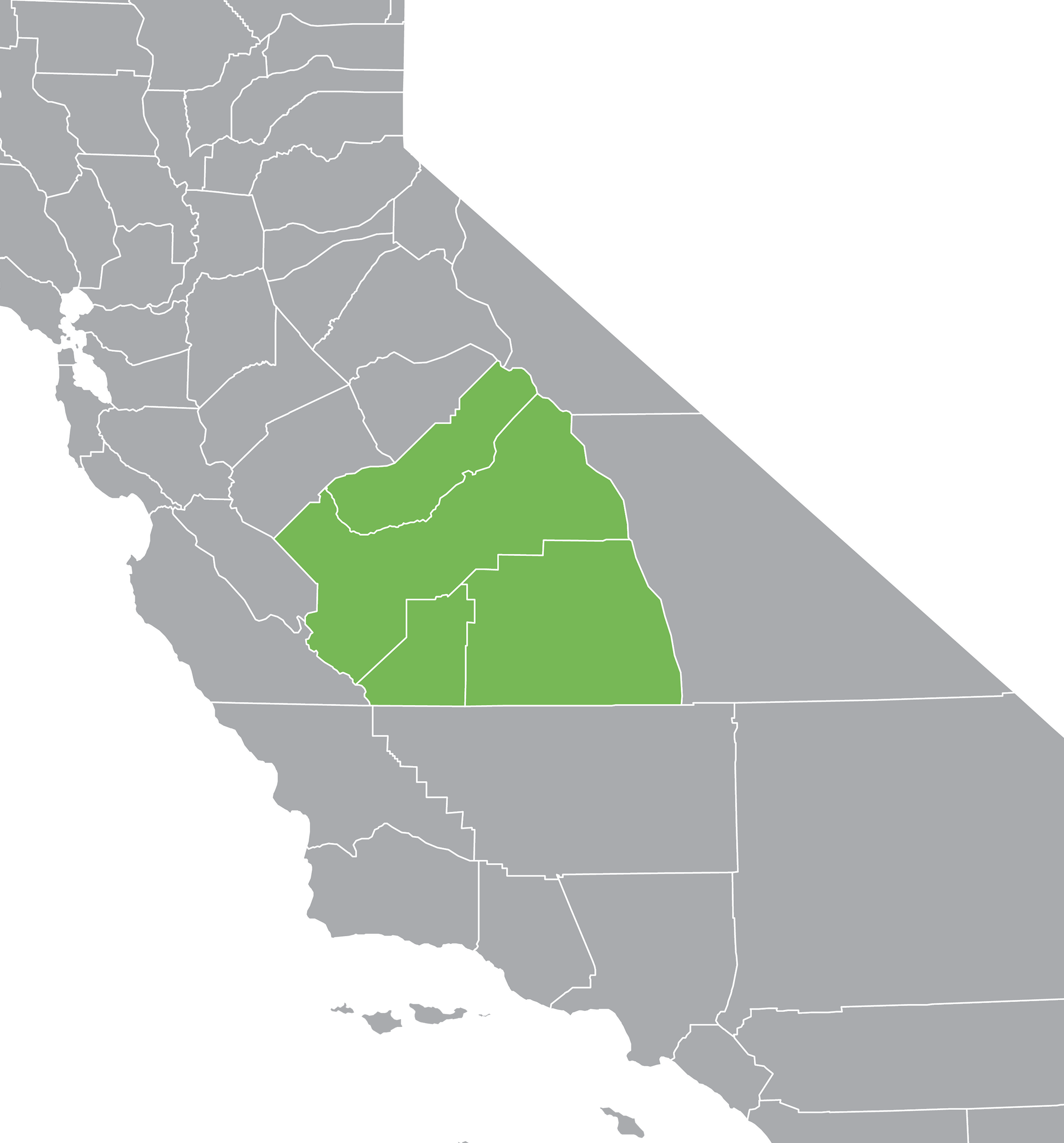

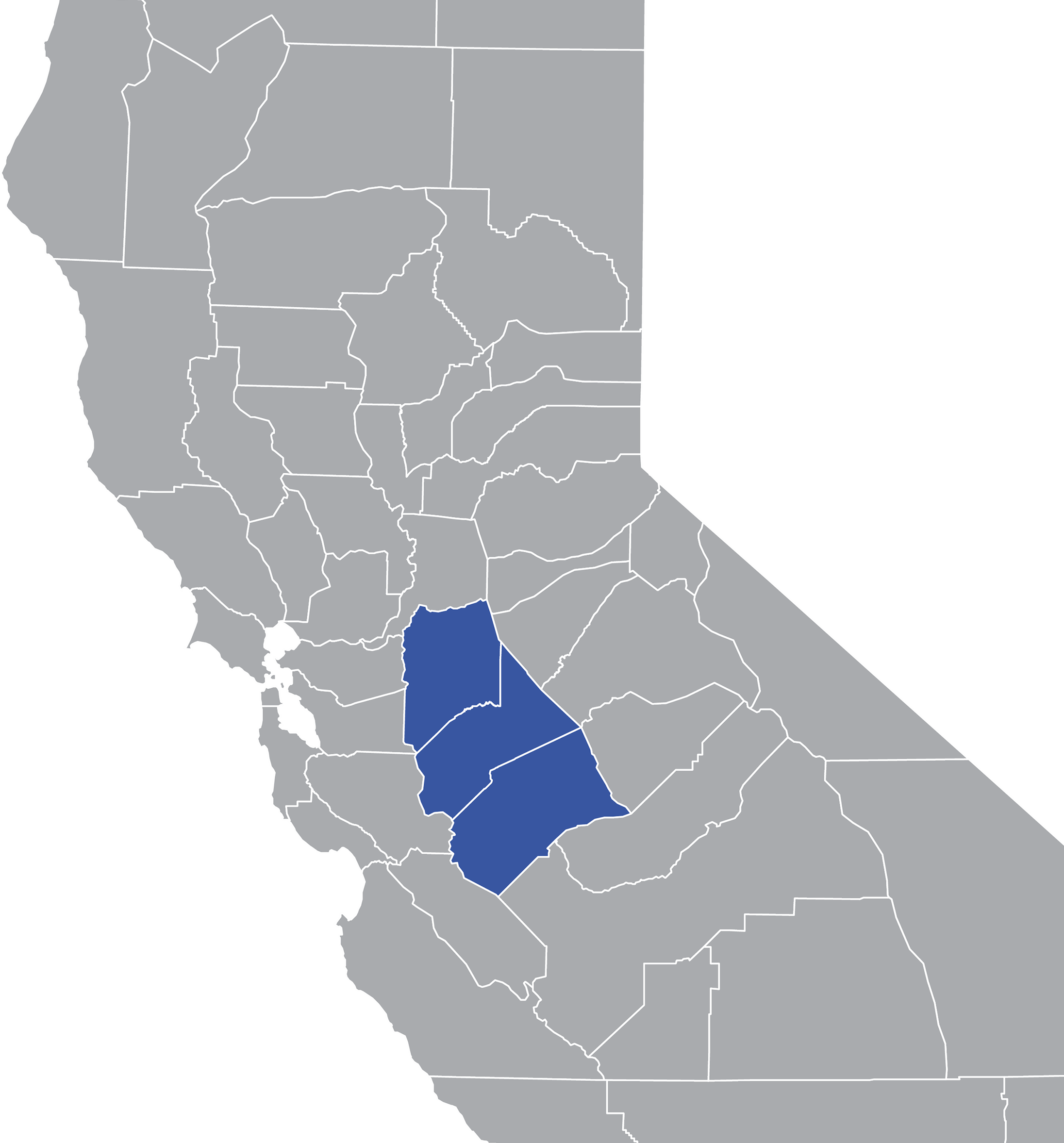

Webthe median property tax in san joaquin county, california is $2,340 per year for a home worth the median value of $318,600. San joaquin county collects, on average, 0. 73% of. Our mission is to ensure the safekeeping of public funds while. Webexplore the charts below for quick facts on san joaquin county effective tax rates, median real estate taxes paid, home values, income levels and homeownership rates, and. Weblearn all about san joaquin real estate tax. Whether you are already a resident or just considering moving to san joaquin to live or invest in real estate, estimate local. Webthe median property tax (also known as real estate tax) in san joaquin county is $2,340. 00 per year, based on a median home value of $318,600. 00 and a median effective. Weboverseeing the property tax billing and collection process for secured and unsecured property taxes levied by california state law, we assist the public in understanding their. Quickly find treasurer & tax collector phone number, directions & services (stockton, ca).

Related Posts

Recent Post

- Craiglist East Texas

- Feria Latina Supermarket

- Www Craigslist Com Ohio Cleveland

- Craigslist In Tucson Az Farm And Garden

- Doublelist Springfield Missouri

- Craigslist Morehead City Nc

- Craigslist Cameron Park

- Texas Tx Lottery Results Lottery Post

- Melbourne Florida Craigslist

- Craigslist Waterbury Ct

- Boise Pets Craigslist

- Craigslist Winchester Ky

- South Dakota Craigslist

- Austin America Craigslist

- Craigslist South Nj Free

Trending Keywords

Recent Search

- Craigslist Ventura For Sale

- Sioux City Craigs List

- Craigslist Biddeford

- Craigslist Jefferson City

- 512 790 8389

- Craigslist For Western Ky

- Chas Sc Craigslist

- Craigs List Port Angeles

- Craigslist Hawaii Kauai

- Shopify Craigslist Listing

- Craigslist Akron Canton

- Craiglist Ithaca Ny

- Craigslist Eureka California

- Craigslist Mcallen General For Sale

- 917 232 2250

/state-income-tax-rates-2-2014-tax-foundation-57a631e35f9b58974a3ad3a4.png)